Are Investors Actually Buying Up All the Homes?

Are Investors Actually Buying Up All the Homes?

Are you trying to buy a home but you feel like you’re up against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, and that’s making it hard for regular buyers like you to compete.

But here’s the truth. Investor purchases are actually on the decline, and the big players aren’t nearly as active as you might think. Let’s dive into the facts and put this myth to rest.

Most Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are mom-and-pop investors who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who have another home they’re renting out or a vacation getaway.

Investor Home Purchases Are Dropping

But what about the big investors you hear about in the news? Lately, those institutional investors – the ones that make headlines – have pulled back and aren’t buying as many homes.

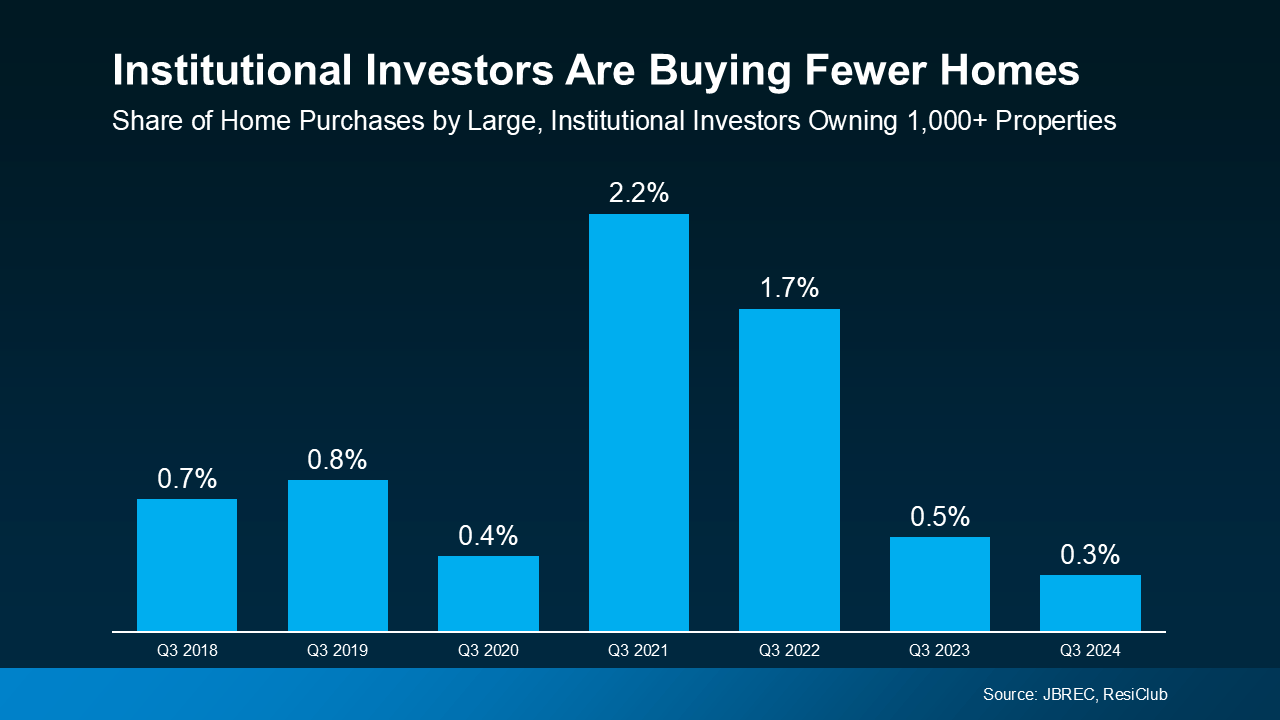

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

Investors are clearly more reluctant to buy in today’s market, but why? The answer is largely because higher mortgage rates and home prices have made it less attractive for them.

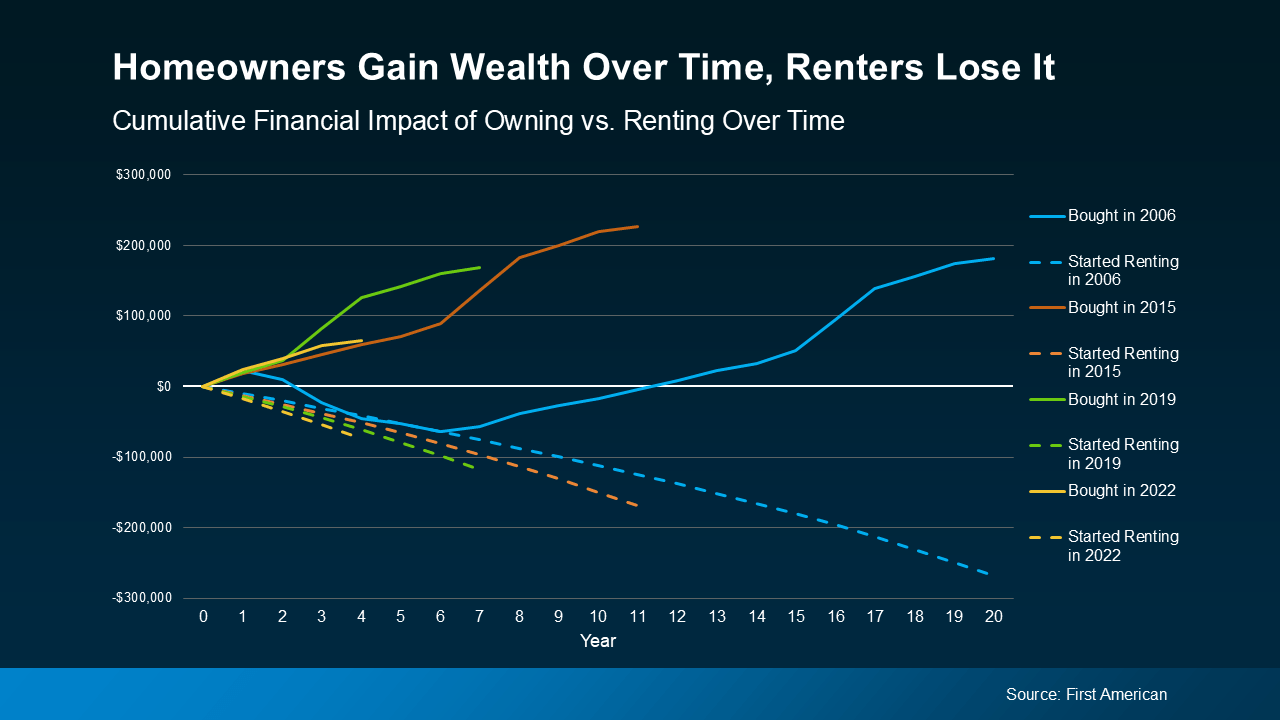

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re not nearly as active as they were in past years.

Bottom Line

Big institutional investors aren’t buying up all the homes – if anything they’re buying less than they have been. Let’s connect and talk about what’s happening in our local market. There could be more opportunities than you think.

How does knowing investors are buying fewer homes change the way you see your chances in today’s market?

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION