Buyer Traffic Is Still Stronger than the Norm

Buyer Traffic Is Still Stronger than the Norm

Are you putting off selling your house because you’re worried no one’s buying because of where mortgage rates are? If so, know this: the latest data shows plenty of buyers are still out there, and they’re purchasing homes today. Here’s the data to prove it.

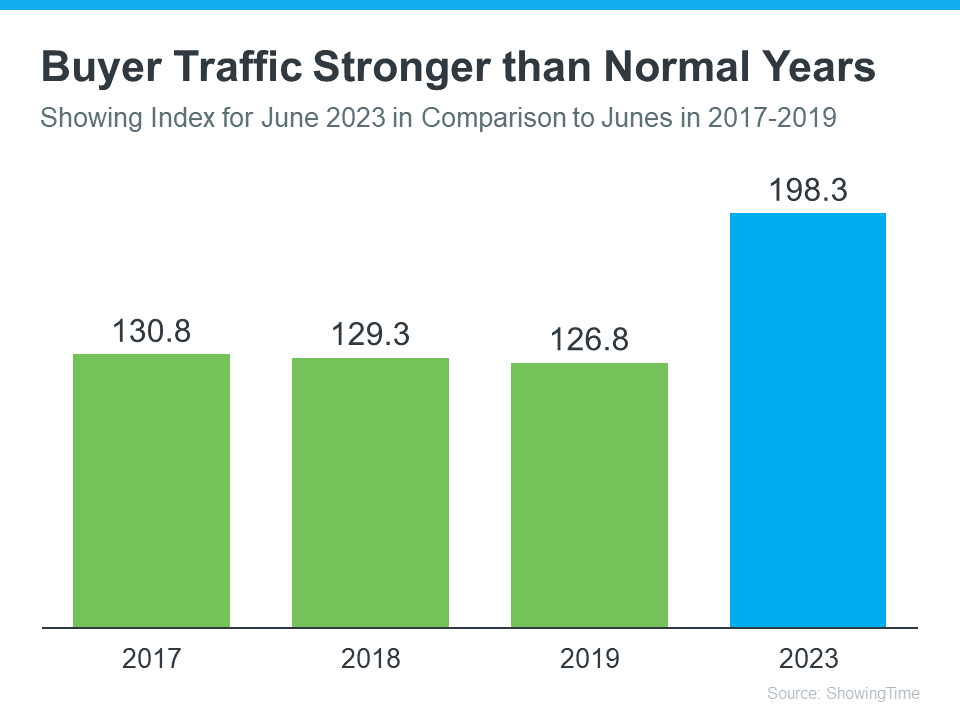

The ShowingTime Showing Index is a measure of buyers touring homes. The graph below uses the latest numbers available and compares them to the same month in the last normal years to show just how active today’s buyers still are:

As you can see, when June 2023 numbers are stacked alongside what’s typical for the housing market at this time of year, it's clear buyers are still active. And, they’re actually a lot more active than the norm.

As you can see, when June 2023 numbers are stacked alongside what’s typical for the housing market at this time of year, it's clear buyers are still active. And, they’re actually a lot more active than the norm.

If you’re wondering how this could possibly be true, it’s because buyers are getting used to higher mortgage rates and accepting them as the new reality. As Danielle Hale, Chief Economist, Realtor.com, explains:

“Interest rate hikes continue to further cut into buyers' purchasing power, although they appear to have adapted to the higher mortgage rate environment . . .”

It’s simple. Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

The Key Takeaway for You

While it’s true things have slowed down from the frenzy of the last couple of years, it doesn’t mean today’s market is at a standstill. The reality is: buyer traffic is still strong today. Even with today’s mortgage rates, plenty of buyers are still making their moves. So why delay your own move when there’s clearly a market for your house?

Bottom Line

Don’t put off your plans because you’re worried no one will buy your home. The opposite is true, and more buyers are more active than the norm. Let’s connect to get your house ready to sell, so it makes the best first impression possible on those eager buyers.

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION