Explaining Today’s Mortgage Rates

Explaining Today’s Mortgage Rates

Are you keeping an eye on mortgage rates because you want to stay informed on how they affect your borrowing expenses? You might be curious about what the future holds for these rates, but the truth is that predicting mortgage rates is a difficult feat.

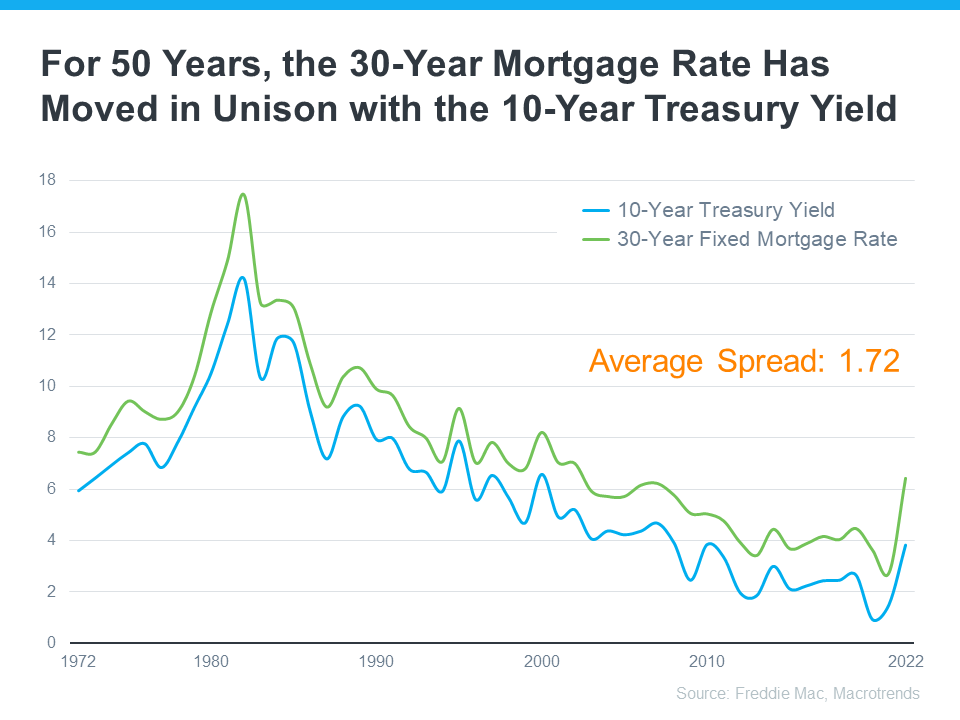

But, there’s one thing that’s historically a good indicator of what’ll happen with rates, and that’s the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Here’s a graph showing those two metrics since Freddie Mac started keeping mortgage rate records in 1972:

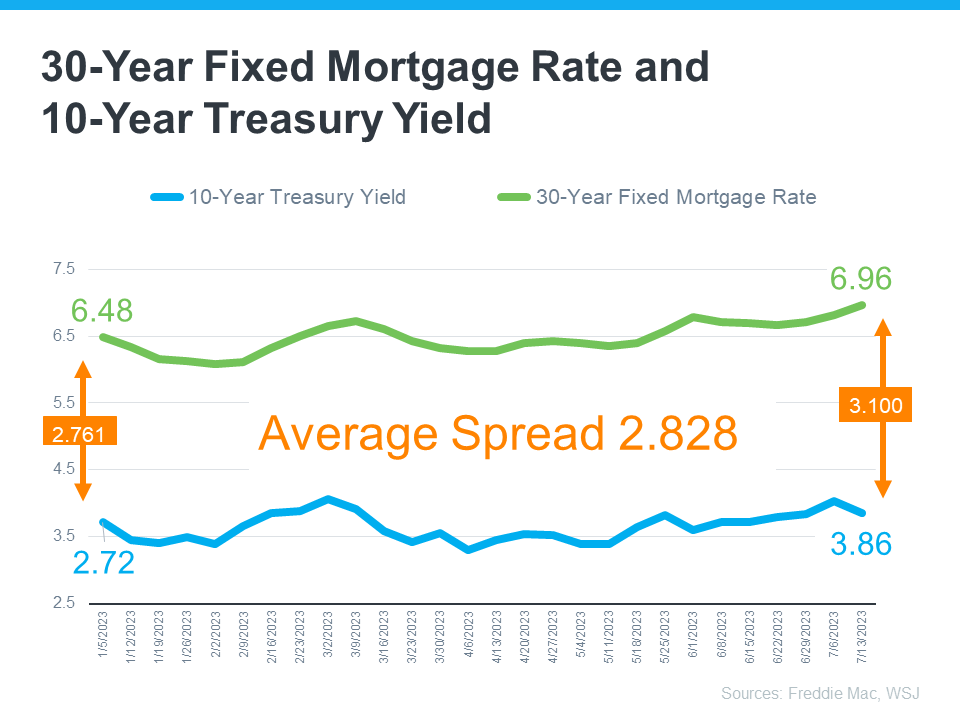

As the graph shows, historically, the average spread between the two over the last 50 years was 1.72 percentage points (also commonly referred to as 172 basis points). If you look at the trend line you can see when the Treasury Yield trends up, mortgage rates will usually respond. And, when the Yield drops, mortgage rates tend to follow. While they typically move in sync like this, the gap between the two has remained about 1.72 percentage points for quite some time. But, what’s crucial to notice is that spread is widening far beyond the norm lately (see graph below):

If you’re asking yourself: what’s pushing the spread beyond its typical average? It’s primarily because of uncertainty in the financial markets. Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve (The Fed) are all influencing mortgage rates and a widening spread.

Why Does This Matter for You?

Understanding the spread may seem a bit technical and detailed, but it's actually important for homebuyers like you to know. Essentially, it means that there's potential for mortgage rates to improve today, based on the usual historical difference between two rates. So, it's definitely worth keeping in mind!

And, experts think that’s what lies ahead as long as inflation continues to cool. As Odeta Kushi, Deputy Chief Economist at First American, explains:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal . . . However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Similarly, an article from Forbes says:

“Though housing market watchers expect mortgage rates to remain elevated amid ongoing economic uncertainty and the Federal Reserve’s rate-hiking war on inflation, they believe rates peaked last fall and will decline—to some degree—later this year, barring any unforeseen surprises.”

Bottom Line

As a first-time home buyer or current homeowner looking for a better fit, staying informed about mortgage rates and expert predictions for the future is essential. Keep yourself updated on the latest developments to make informed decisions. And as always, feel free to reach out to me if you have any questions!

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION