How To Know If You’re Ready to Buy a Home

How To Know If You’re Ready to Buy a Home

If you're considering buying a home, it's understandable that you might have a lot of thoughts racing through your mind. You're probably taking your finances, current mortgage rates and home prices, and the limited availability of homes for sale into account, among other factors. It can be a lot to balance, but ultimately it will help you make the right decision for you.

While housing market conditions are definitely a factor in your decision, your own life and your finances may be even more important. As an article from NerdWallet says:

“Housing market trends give important context. But whether this is a good time to buy a house also depends on your financial situation, life goals and readiness to become a homeowner.”

Instead of trying to time the market, it may help to focus on what you can control. Here are a few questions that can give you clarity on whether you’re ready to make your move.

1. Do You Have a Stable Job?

One thing to consider is how stable you feel your employment is. Buying a home is a big purchase, and you’re going to sign a home loan stating you’re going to pay that loan back. That can feel like a big obligation. Knowing you have a reliable job and income coming in can help put your mind at ease. As NerdWallet explains:

“A mortgage is a big commitment . . . Wait until your employment is stable before thinking about buying a house.”

2. Have You Figured Out What You Can Afford?

If you want to get a clear understanding of how much you need to save and how much you'll be spending on your monthly payment, don't hesitate to reach out to a trusted lender. They can guide you through the pre-approval process and let you know how much you can borrow, the current mortgage rates, the approximate monthly payments, the expected closing costs, the percentage of the purchase price required as a down payment, and other important details. So, don't hesitate to get in touch with your lender and get the information you need to make informed decisions about your home purchase.

The best part is you may find out you’re closer to your goals than you realized. You don’t necessarily need to put 20% down, unless it’s specified by your lender or loan type. As Down Payment Resource says:

“A 20% down payment on a home is great, but . . . Many mortgages require no more than 3% to 5% of the purchase price as a down payment. Plus, there are loans and grants that may help cover these costs. Search for down payment assistance in your area, and discuss your results with your mortgage lender . . .”

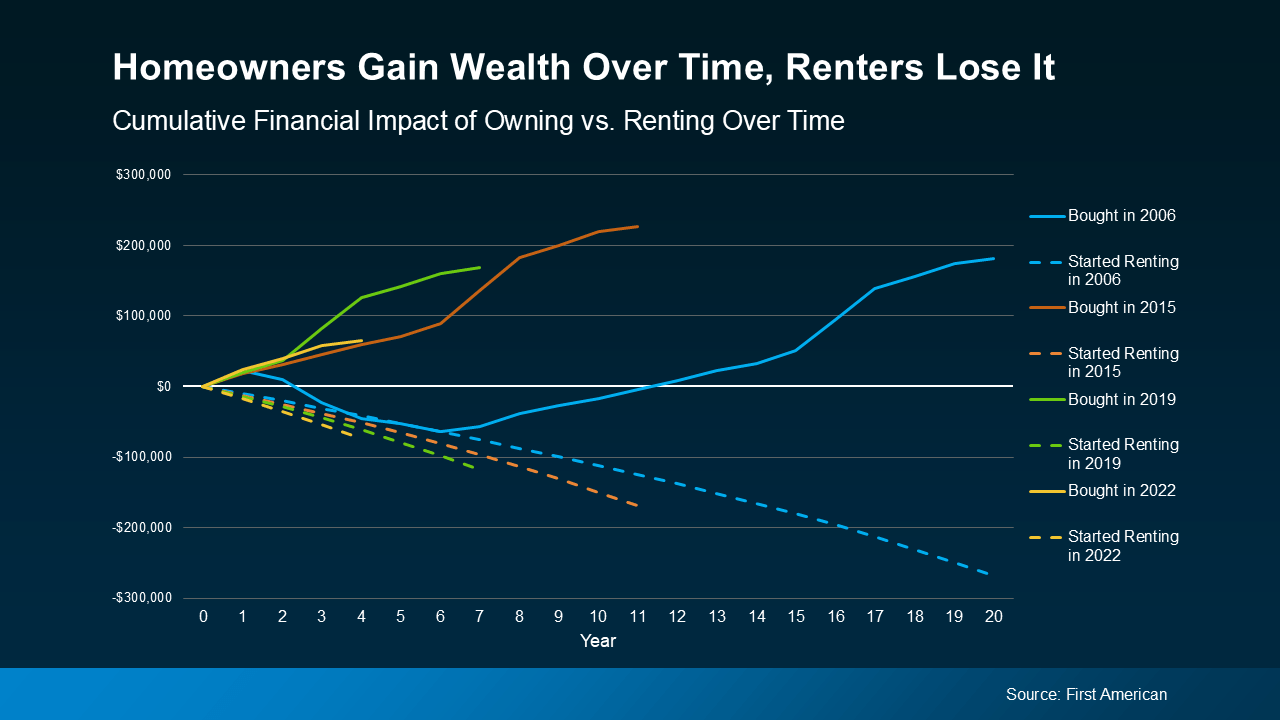

3. How Long Do You Plan to Live There?

Another important thing to think about is how long you plan to stay put. It takes time to build equity in your home through paying down your loan and home price appreciation. If you plan to move too soon, you may not recoup your investment. For example, if you’re looking to sell and move again in a year, it might not make sense to buy right now. As a recent article from CNET says:

“Buying a home is a good idea if you’re planning to stay put for at least three years. Home values typically increase between 2% and 5% annually, so you could end up paying more in closing costs than you’d earn in proceeds if you sell after only a year or two.”

So, think about your future. If you plan to transfer to a new city with the upcoming promotion you’re working toward or you anticipate your loved ones will need you to move closer to take care of them, that’s something to factor in.

Above all else, the most important question to answer is: do you have a team of real estate professionals in place? If not, finding a trusted local agent and a lender is a good first step.

Bottom Line

To determine if you're prepared to purchase a home, these inquiries can certainly assist. Nonetheless, the ultimate and most dependable source of guidance is the assistance of reputable real estate experts.

Categories

- All Blogs 336

- build your home 32

- builders 17

- buyers market 90

- buying a home 191

- closing costs 14

- condominiums 10

- credit 6

- dallas real estate 5

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth real estate 2

- home affordability 65

- home equity 9

- home loan 75

- home ownership 117

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 3

- mortgage 66

- mortgage rates 49

- new construction 14

- new home 31

- owning a home 42

- preapproval 22

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 103

- selling your home 106

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION