Smart Moves for First-Time Buyers

If you’re like a lot of aspiring homebuyers, there’s a major hurdle standing in your way — the cost of living. From groceries to gas, eggs, and just about everything else, prices have gone up. And that rings true for home prices, too.

But even when everything feels expensive, there are still ways to make homeownership more than an item on your wish list. You may just need to think about where you plan to buy a bit differently.

Think of Your First Home as a Stepping Stone

One of the biggest misconceptions among buyers is that their first home has to be their forever home – or that it has to check all the boxes of what they want right out of the gate. In reality, it’s just a starting point.

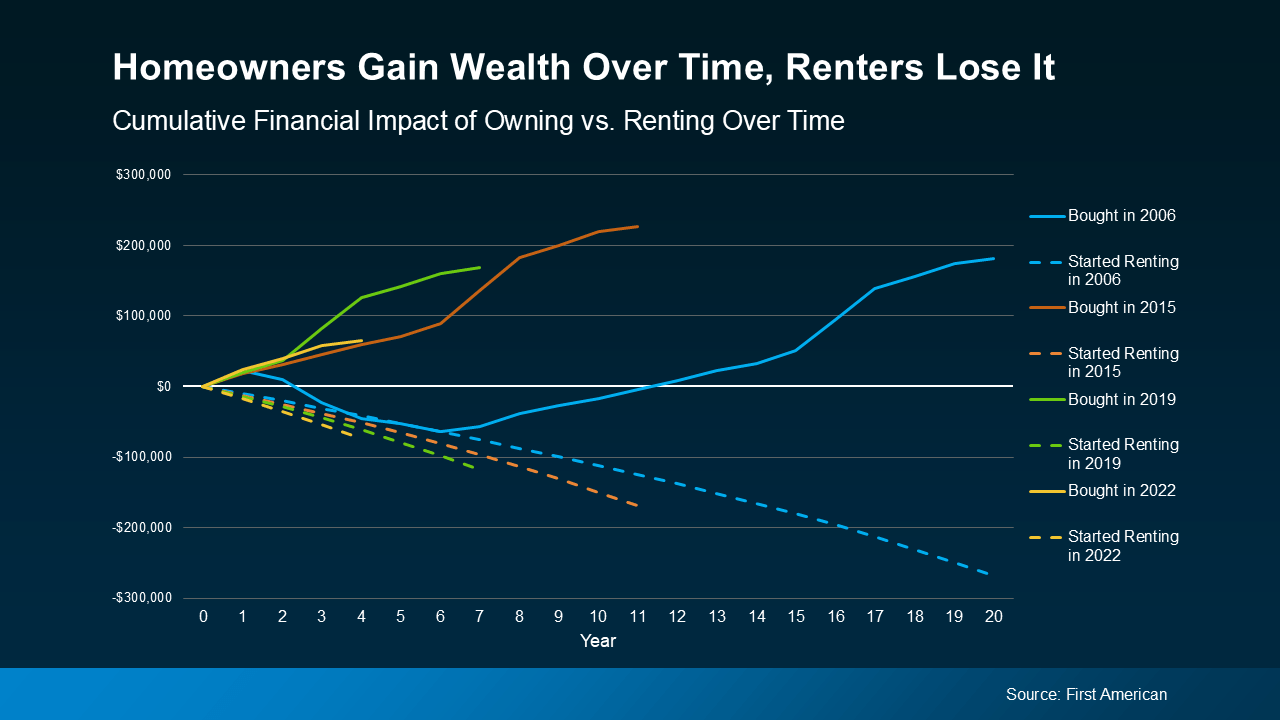

Once you own a home, you start to build equity, which grows over time as home prices rise. Down the road, if you want to move — whether to a larger space, a better location, or both — the equity you’ve gained can help you do just that.

So rather than waiting until you can afford your dream home in your ideal neighborhood, consider starting with something that works for now.

Expand Your Search To Find More Affordable Options

If high home prices in your favorite area are holding you back, it’s time to cast a wider net. By keeping an open mind and being flexible with location, you may be surprised at what’s possible within your budget. Many buyers find success by looking in surrounding areas – and some even choose to move out of state.

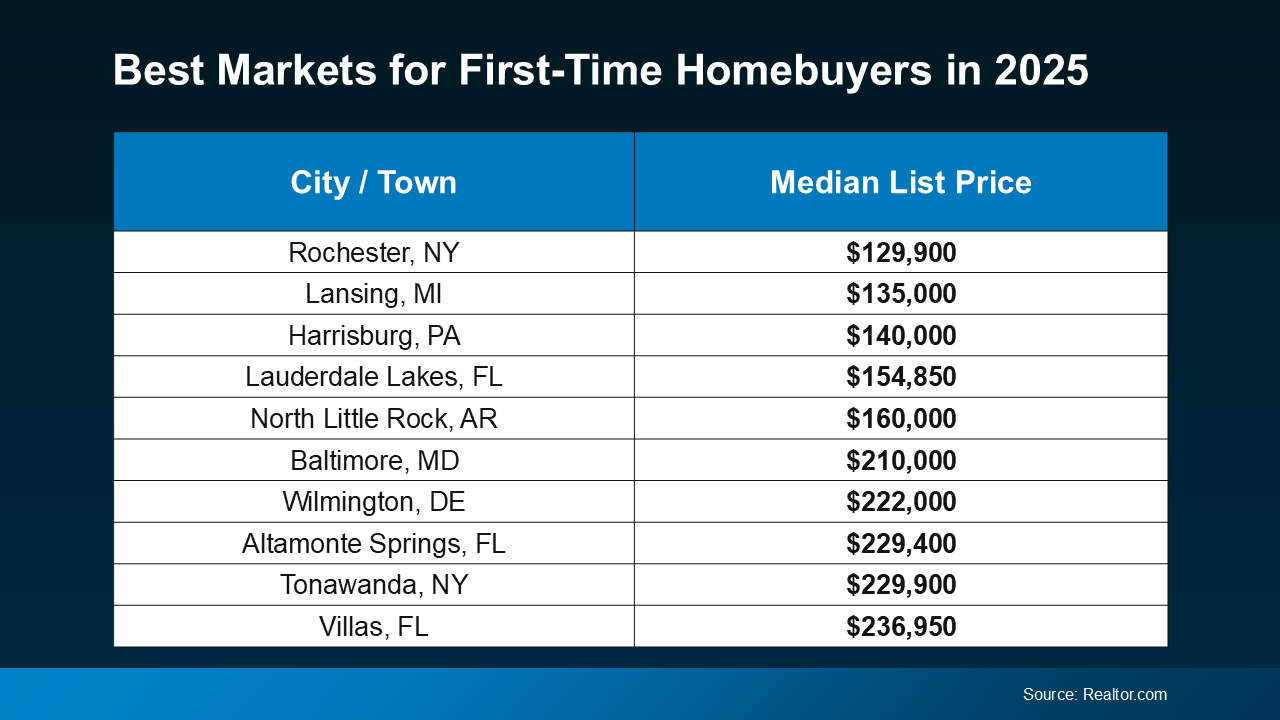

According to a report from Realtor.com, these are some of the best markets for first-time homebuyers this year (see chart below):

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

If you want to stay local, looking just outside your preferred neighborhood could help you find something you can afford that’s still pretty close to your favorite restaurants, shops, and activities. Sometimes, moving as little as 10 minutes away makes a big difference.

And the best way to see what’s available is to work with a real estate agent who understands the local market and can help you identify hidden gems nearby. An agent can point you to communities you may not have considered that have lower price tags now and are steadily gaining value and appeal. That way you can buy your first home and be set up to gain equity through the years.

Bottom Line

Today’s cost of living is a challenge for many homebuyers. But by exploring different areas and working with a knowledgeable agent, you can take that first step toward owning a home — and building equity for your future.

How far outside of your area would you look to make homeownership happen? Let’s connect to chat through your options.

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION