The Impact of Inflation on Mortgage Rates

The Impact of Inflation on Mortgage Rates

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know.

Inflation and the Housing Market

While the Fed’s working hard to lower inflation, the latest data shows that, while the number has improved some, the inflation rate is still higher than the target (2%). That played a role in the Fed's decision to raise the Federal Funds Rate last week. As Bankrate explains:

“Keeping its inflation-fighting streak alive, the Federal Reserve has raised interest rates for the 10th time in 10 meetings . . . The hikes aimed to cool an economy that was on fire after rebounding from the coronavirus recession of 2020.”

While the Fed’s actions don’t directly dictate what happens with mortgage rates, their decisions do have an impact and contributed to the intentional cooldown in the housing market last year.

How This Impacts You

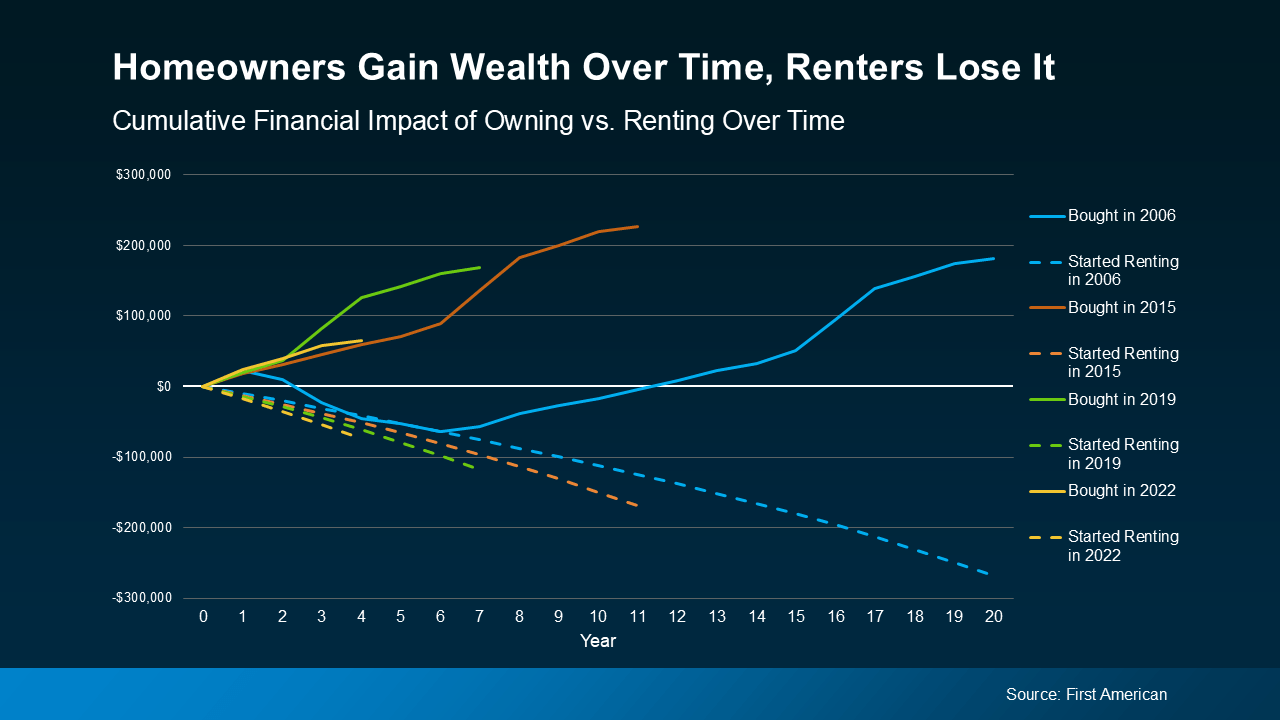

During times of high inflation, your everyday expenses go up. That means you’ve likely felt the pinch at the gas pump and in the grocery store. By raising the Federal Funds Rate, the Fed is actively trying to lower inflation. If the Fed is successful, it could also ultimately lead to lower mortgage rates and better homebuying affordability for you. That’s because when inflation is high, mortgage rates tend to be high. But, as inflation cools, experts say mortgage rates will likely fall.

Where Experts Think Mortgage Rates and Inflation Will Go from Here

Moving forward, both inflation and mortgage rates will continue to impact the housing market. And as Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Mortgage rates are likely to descend lower later in the year as the consumer price inflation calms down . . .”

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:

“We continue to expect that mortgage rates will drift down over the course of the year as the economy slows . . .”

While there’s no way to say with certainty where mortgage rates will go from here, the experts think mortgage rates will trend down this year if inflation comes down too. To stay informed on the latest insights, connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting and how it could impact your homeownership plans.

Bottom Line

Don’t let headlines about the latest decision from the Fed confuse you. Where mortgage rates go from here depends on what happens with inflation. If inflation cools, mortgage rates should tick down as a result. Let’s connect so you have expert insights on housing market changes and what they mean for you.

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION