The Surprising Amount of Home Equity You’ve Gained over the Years

The Surprising Amount of Home Equity You’ve Gained over the Years

There are a number of reasons you may be thinking about selling your house. And as you weigh your options, you may find you’re unsure how you’re going to deal with one thing about today’s housing market – and that’s affordability. If that’s your biggest concern, understanding how much equity you have in your house could help make your decision that much easier. Here are two key factors that have a big impact on your equity.

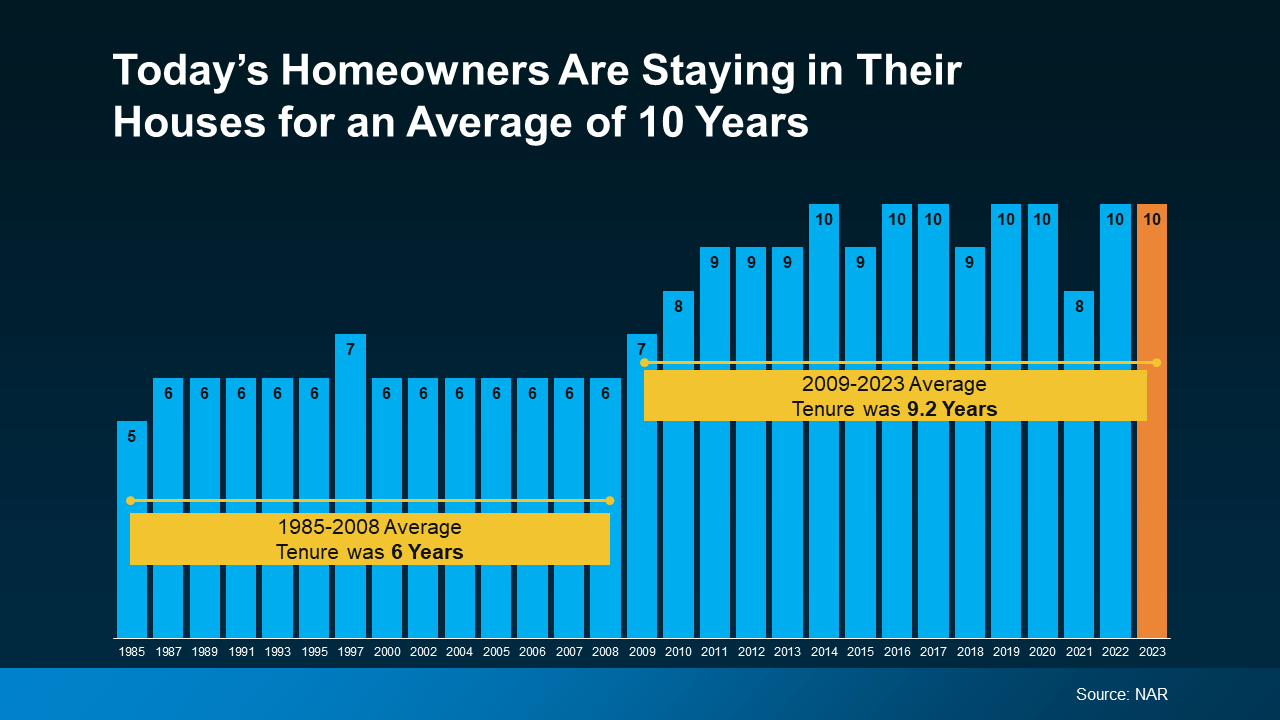

How Long You’ve Been in Your Home

First up is homeowner tenure. That’s how long homeowners live in a house, on average, before selling or choosing to move. From 1985 to 2009, the average length of time homeowners stayed put was roughly six years.

But according to the National Association of Realtors (NAR), that number has been climbing. Now, the average tenure is 10 years (see graph below):

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

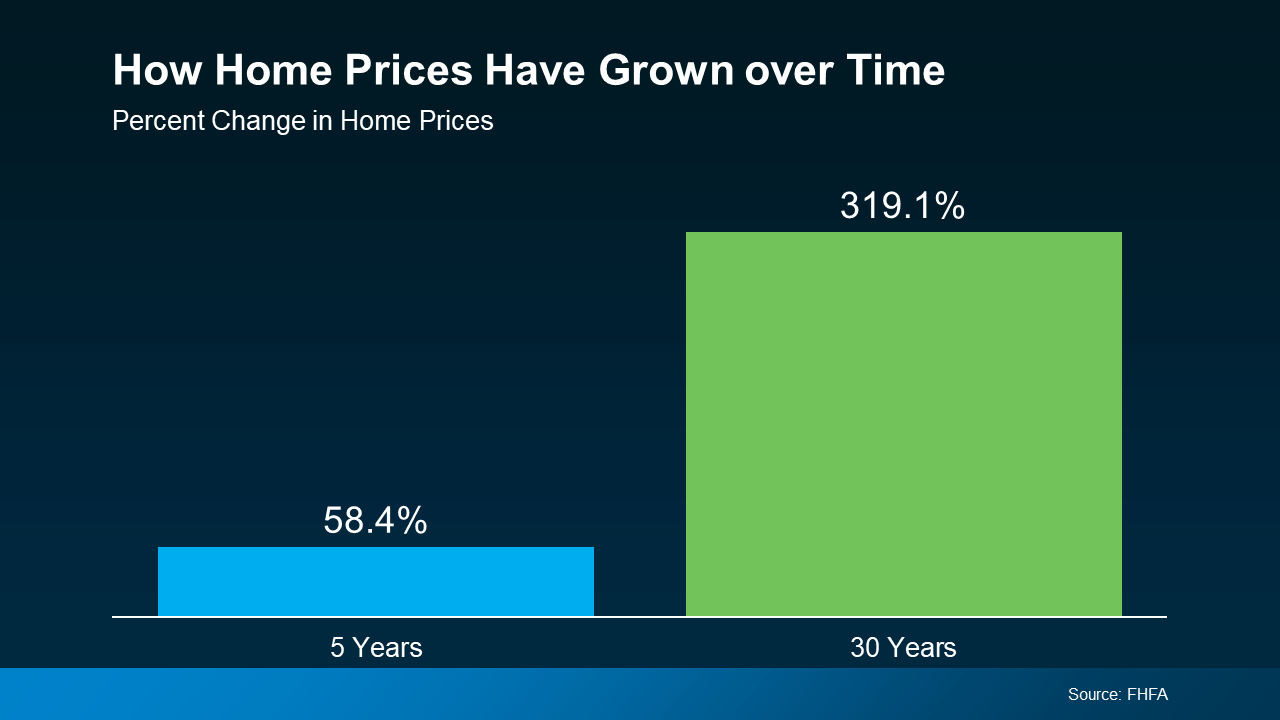

How Home Prices Appreciate over Time

To help show how much the price appreciation piece adds up, take a look at this data from the Federal Housing Finance Agency (FHFA) (see graph below):

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

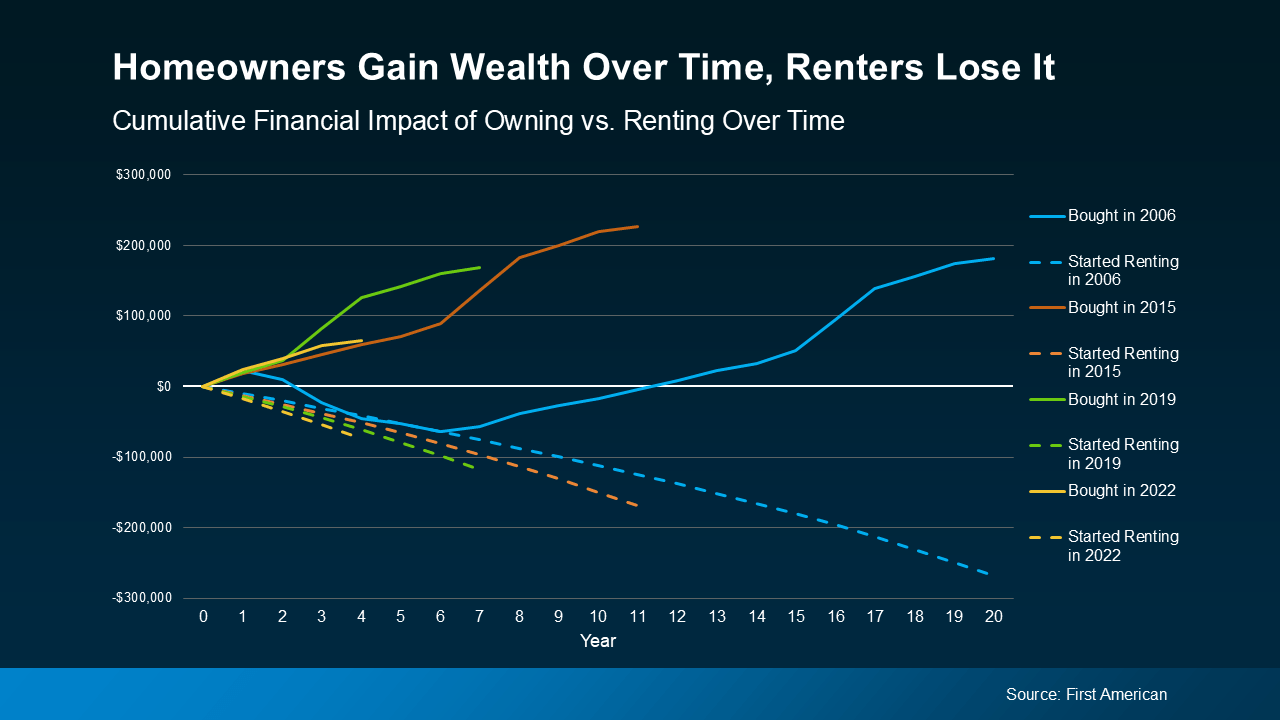

Whether you’re looking to downsize, relocate to a dream destination, or move so you can live closer to friends or loved ones, your equity can be a game changer.

Bottom Line

If you want to find out how much equity you’ve built up over the years and how you can use it to buy your next home, let’s connect.

Categories

- All Blogs 342

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 195

- closing costs 14

- Community 2

- condominiums 10

- credit 6

- Dallas 1

- dallas real estate 8

- DFW Lifestyle 2

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth 1

- Fort Worth real estate 3

- home affordability 65

- home equity 9

- home loan 75

- home ownership 118

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 2

- local events 2

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 4

- Mansfield, TX 2

- Midcities 1

- mortgage 67

- mortgage rates 50

- moving to Texas 1

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 23

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- relocating to Texas 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION