Today’s Tale of Two Housing Markets

Depending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in different directions. In some places, buyers are calling the shots. In others, sellers still hold the power. It’s a tale of two markets.

What’s a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are more homes for sale and not as many buyers. That means homes sit longer, buyers have more negotiating power, and prices tend to soften as a result. It’s simple supply and demand.

On the flip side, a seller’s market happens when there aren’t enough homes available for the number of people looking to buy them. Because buyers have to compete with each other to get the house they want, that leads to faster sales, multiple offers, and rising prices.

Right now, both of these scenarios are playing out, depending on where you are. So, how do you know what kind of market you’re in? Lean on a local real estate agent. They’ll explain what’s really happening in your area based on these key drivers.

The Number of Buyers and Sellers by Region

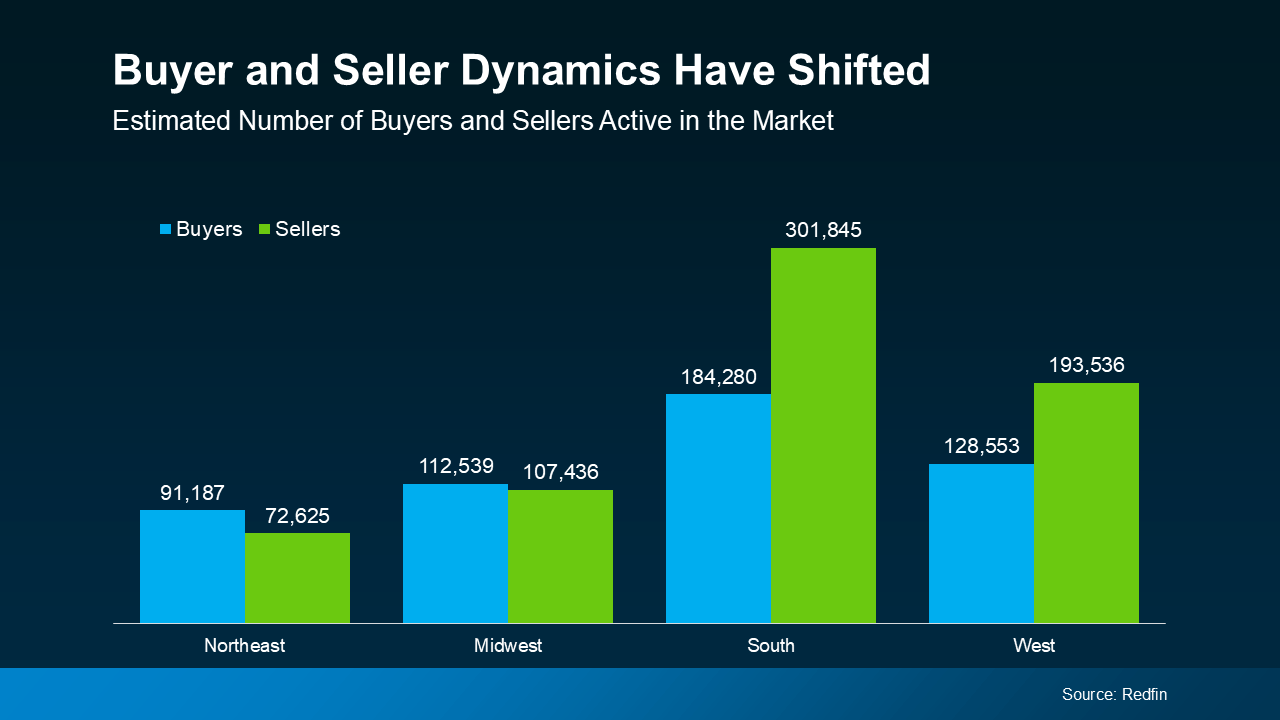

One of the biggest factors impacting each market is the number of active buyers and sellers. According to Redfin, here’s what that looks like by region (see graph below):

Today, the Northeast and Midwest are more likely to be seller’s markets. Buyers still outnumber sellers there, and that keeps things tilted in favor of homeowners. Generally speaking, homes are selling faster and prices are rising in those areas.

Today, the Northeast and Midwest are more likely to be seller’s markets. Buyers still outnumber sellers there, and that keeps things tilted in favor of homeowners. Generally speaking, homes are selling faster and prices are rising in those areas.

But the South and West are leaning more toward buyer’s markets. There are more sellers than buyers, which means more listings to choose from and less competition among buyers.

That’s a major shift from a few years ago when sellers had the advantage almost everywhere. Today, your local conditions matter more than ever – and they can vary even from one neighborhood to the next.

Price Trends Mirror the Buyer/Seller Divide

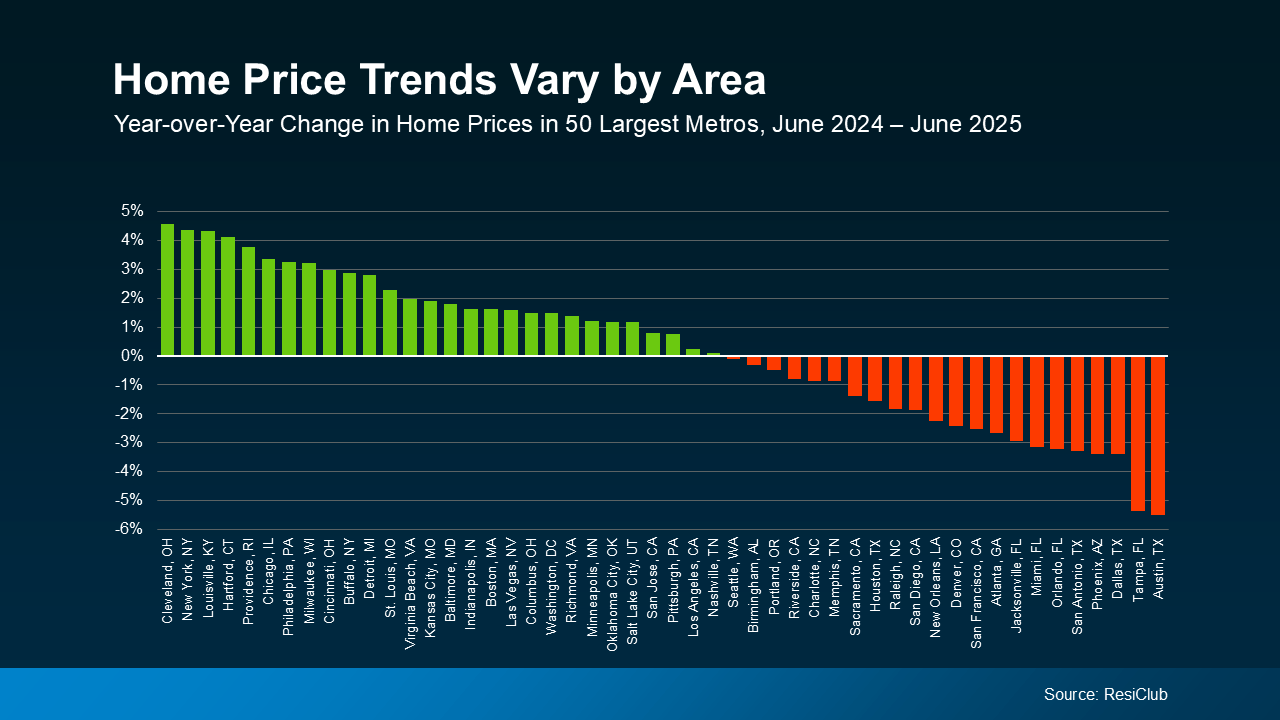

When inventory and buyer activity shift, so do prices. In places where demand still outpaces supply, like much of the Northeast and Midwest, prices are continuing to climb.

But in parts of the South and West where inventory is up and demand has cooled, prices are softening. And that’s a plus for buyers looking to negotiate in those areas.

Here’s the latest price data from ResiClub to show how this divide is shaking out across the top metros in the country (see graph below):

This is why it’s the tale of two markets. Roughly half of the top 50 metros are up, and half are relatively flat or down.

This is why it’s the tale of two markets. Roughly half of the top 50 metros are up, and half are relatively flat or down.

That said, don’t panic if you own a home in a market where prices are dipping. Most homeowners have built up significant equity over the past few years, and chances are you have too. So, you’re likely still come out way ahead when you sell.

Why Local Insights Matter

Even in regions that lean more buyer-friendly right now, there will be cities, towns, and even neighborhoods that don’t follow the regional trends. That’s why an agent’s local market expertise is so important. They can help you understand what’s happening all the way down to a zip code level, including:

- Whether your area is favoring buyers or sellers

- How to set the right price or craft an offer strategy based on local trends

- The best way to make your move happen, no matter what’s happening in the market

Bottom Line

In a market where conditions vary this much from place to place, success starts with understanding every aspect of your local area. Let’s connect so you’ve got an expert in your corner who knows exactly how to guide you through your market, wherever you are.

Categories

- All Blogs 339

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 192

- closing costs 14

- condominiums 10

- credit 6

- dallas real estate 6

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth real estate 2

- home affordability 65

- home equity 9

- home loan 75

- home ownership 117

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 3

- mortgage 66

- mortgage rates 49

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 42

- preapproval 22

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION