Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier

Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits your needs.

If it's too big, too costly, or just not convenient anymore, downsizing might help you make the most of your retirement years. To find out if a smaller, more manageable home might be the perfect fit for your new lifestyle, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

If you answered yes to any of these, consider the benefits that come with downsizing.

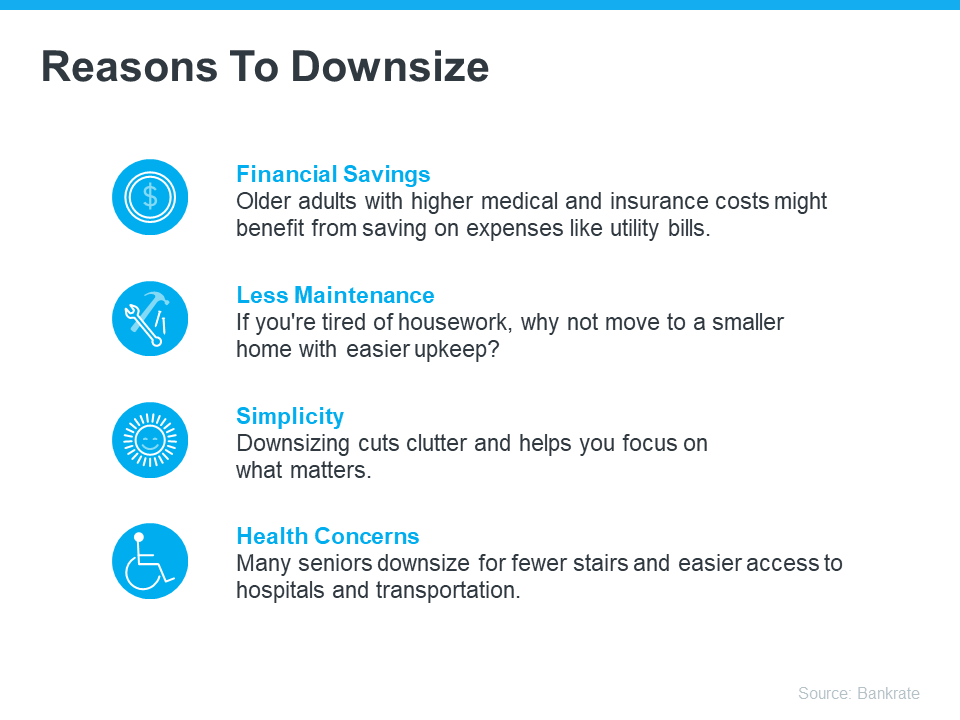

The Benefits of Moving into a Smaller Home

There are many reasons why you should downsize. Here are just a few from Bankrate:

Your Equity Can Help Make Downsizing Possible

If those perks sound like something you’d want, you may already have what you need to make it happen. A recent article from Seniors Guide shares:

“And at a time when homeowners age 62 and older have more than $12 trillion in home equity, downsizing makes sense . . .”

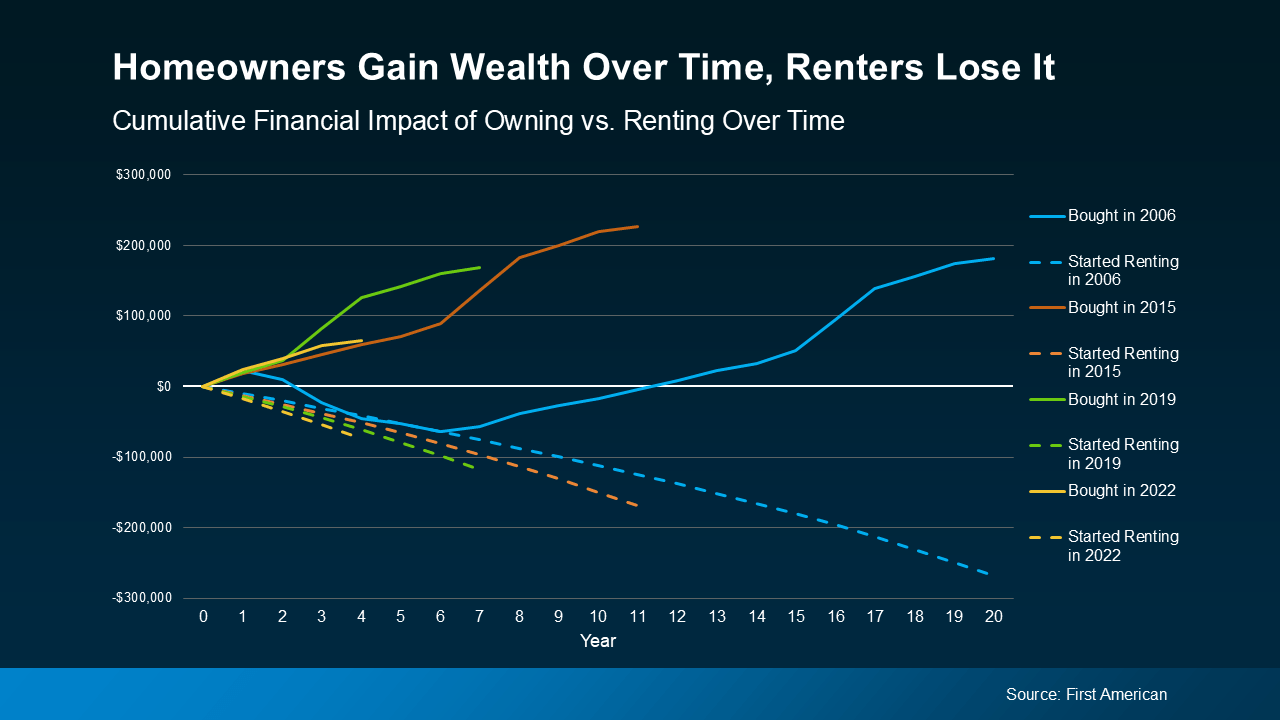

If you’ve been in your house for a while, odds are you’re one of those homeowners who’s built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Downsizing can mean taking that equity when the home is sold and using it to pay cash or make a large down payment on a lower-priced home, reducing your monthly living expenses.”

When you’re ready to use all that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

Bottom Line

Starting your retirement journey? Think about downsizing – it could really help. When you're ready, let’s connect.

Categories

- All Blogs 340

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 193

- closing costs 14

- Community 1

- condominiums 10

- credit 6

- dallas real estate 7

- DFW Lifestyle 1

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth real estate 2

- home affordability 65

- home equity 9

- home loan 75

- home ownership 117

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 1

- local events 1

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 3

- Mansfield, TX 1

- mortgage 66

- mortgage rates 49

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 22

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION