How Your Tax Refund Can Help Purchase a Home

Are You Saving Up To Buy a Home? Your Tax Refund Can Help

You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So, if you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home, like the down payment and closing costs. And here’s the best part.

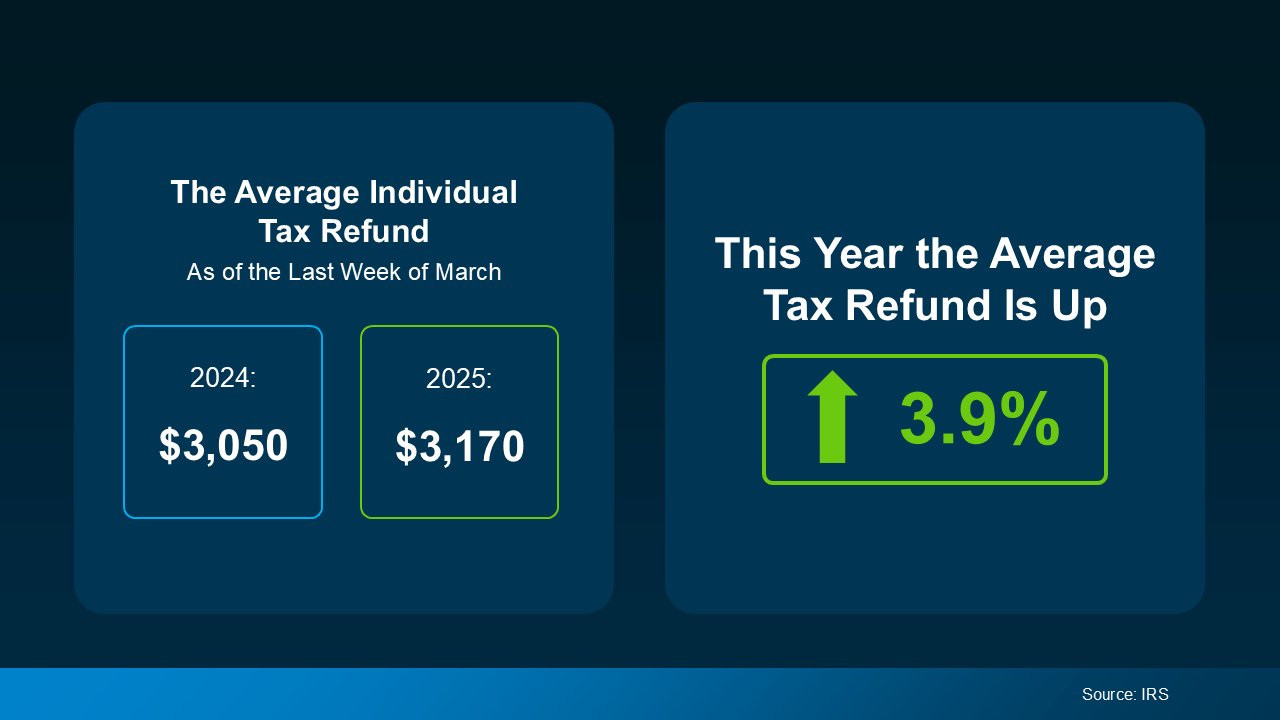

On average, people are getting even more money back in their refunds than they did last year. While it’s not a big increase, the visual below uses data from the Internal Revenue Service (IRS) to show the average individual’s refund is 3.9% higher this year:

Of course, how much money you may get in your tax refund is going to vary. But when it comes to buying a home, any extra cash can help move things forward. Here are a few examples of how you can put that money to good use, according to Freddie Mac:

- Save for a down payment – Saving for a down payment can be one of the biggest hurdles for buyers. Setting aside your tax refund for this expense could help you get to your goal faster. Just remember, it’s typically not required to put 20% down.

- Pay for closing costs – Closing costs include fees for things like the appraisal, title insurance, and underwriting of your loan. They’re generally between 2% and 5% of the total purchase price of the home. So, putting your refund toward these costs can make things more manageable on closing day.

- Lower your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If you qualify for this option, you could pay up front to have a lower rate on your mortgage. If affordability is tight for you at today’s rates and home prices, this may be worth exploring.

But you don’t have to figure it all out on your own. Working with a team of trusted real estate professionals who understand the homebuying process, what you need to save, and any resources you can tap into will help you make sure you’re ready to buy when the time comes.

Bottom Line

When it comes to saving for a home, every dollar gets you one step closer to your goal. While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost.

What would having your own home mean for you or your family this year? Let’s talk about it and we’ll come up with a strategy for success.

Categories

- All Blogs 340

- Arlington, TX 1

- build your home 32

- builders 17

- burleson 1

- buyers market 91

- buying a home 193

- closing costs 14

- Community 1

- condominiums 10

- credit 6

- dallas real estate 7

- DFW Lifestyle 1

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth real estate 2

- home affordability 65

- home equity 9

- home loan 75

- home ownership 117

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- Living in DFW 1

- Living In Texas 1

- local events 1

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 3

- Mansfield, TX 1

- mortgage 66

- mortgage rates 49

- neighborhood news 1

- new construction 14

- new home 31

- owning a home 43

- preapproval 22

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 104

- selling your home 107

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION