Why Now May Be a Key 2025 Moment To Sell Your House

Mortgage rates are finally heading in the right direction – and buyers are starting to jump back in.

According to the data, buyer demand picked up considerably once mortgage rates hit a new low for 2025. The Mortgage Bankers Association (MBA) reports that applications for home loans were up 23% compared to the first week of September last year.

If you’ve been waiting to sell, or your listing recently expired because the market was slower than you hoped it would be, now’s the time to reconsider your move. Buyer demand is the highest it’s been since July – and you don’t want to miss this window.

When Rates Drop, Buyers React

Here’s what’s happening. The 30-year mortgage rate dropped to 6.13% earlier this week. And that’s the lowest it had been since October 2024. That decline followed weak job growth and other economic indicators that are fueling speculation the Federal Reserve may cut the Federal Funds Rate multiple times this year. Mortgage rates started dropping because financial markets are anticipating those Fed decisions. And that opens the door for more buyers to act.

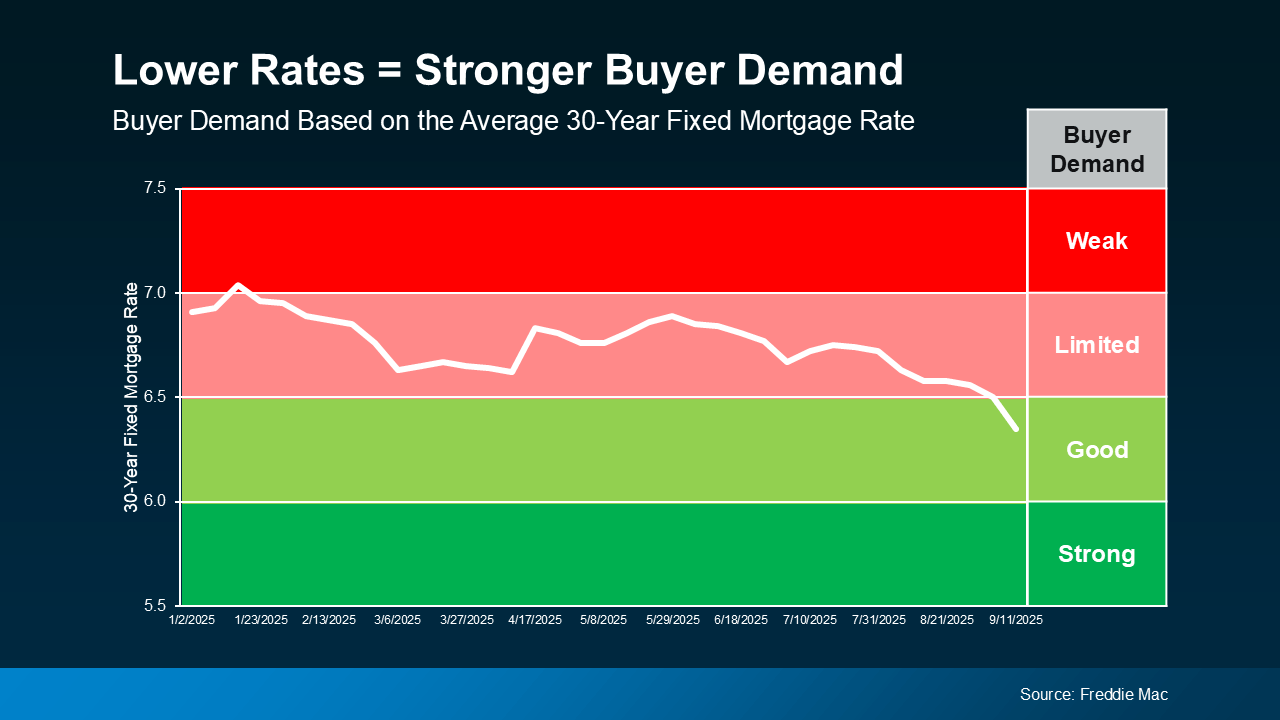

Since today’s buyers are looking at every angle to make home purchases more affordable, they’re much more sensitive to even the slightest movement in mortgage rates. Basically, it boils down to this. As affordability improves, so does buyer demand (see graph below):

And that’s a change you’re going to feel – in a good way. Since about this time last year, we’ve been in a plateau of “limited” buyer demand. But now that rates are coming down, buyer demand is getting better.

And that’s a change you’re going to feel – in a good way. Since about this time last year, we’ve been in a plateau of “limited” buyer demand. But now that rates are coming down, buyer demand is getting better.

What This Means for You

If you’re looking to move, it’s time to get serious about what’s happening in the market, and how you can use these key moments to your advantage. Maybe you have an expired listing that sat without offers earlier this year, or you held off on selling altogether, thinking buyers weren’t out there. This is your signal – they’re coming back. Now, it’s not in the big surge the market saw a few years ago, but this could be your window.

Here’s the opportunity. You can list, while buyer activity is rising and before more sellers in your neighborhood do too. Other homeowners may not see this shift for a while, so you can get a leg up on your competition if you act now.

On the flip side, if you wait, sure there may be more buyers if rates continue to inch down. But there are also going to be more sellers too. So, why take that risk?

A trusted local agent can help you assess your home’s value, fine-tune your pricing strategy, and make sure it stands out to the serious buyers who are taking action today.

Bottom Line

Buyers are watching rates, weighing their options, and starting to get off the sidelines. If you’re thinking about selling, this may be your chance to get ahead.

Want to make sure your house shows up for the right buyers, at the right time?

Let’s connect and walk through the steps together so you can make the most of this moment.

Categories

- All Blogs 325

- build your home 32

- builders 17

- buyers market 89

- buying a home 188

- closing costs 14

- condominiums 10

- credit 6

- dallas real estate 5

- down payment 26

- downsizing 9

- finances 13

- first time home buyer 76

- for sale by owner 1

- Fort Worth real estate 2

- home affordability 65

- home equity 9

- home loan 75

- home ownership 117

- home price 59

- home tips 41

- home value 57

- housing market 123

- interest rates 49

- investment 16

- leasing 1

- listing agent 12

- lower interest rate 2

- luxury homes 1

- Mansfield real estate 3

- mortgage 66

- mortgage rates 49

- new construction 14

- new home 31

- owning a home 42

- preapproval 22

- pricing your home 41

- property management 2

- real estate 149

- real estate tips 124

- relocating 1

- rental 1

- renting 6

- savings 10

- second home 18

- sellers 97

- selling your home 100

- senior living 14

- vacation home 1

- Veterans 2

- wealth 3

Recent Posts

GET MORE INFORMATION